Transformative real-time financial insights from Pulse

Track cash flow, optimise your expenses, and make data driven decisions, helping your business towards growth and success.

Our Partners

Accreditations

.svg)

Features

What Pulse offers

Master Your Receivables

DebtorIQ

Stay on top of late payments with real-time insights into risky customers, and smart follow-up actions. Built into Pulse, it sends custom alerts and offers a downloadable audit report for a clear, shareable view of your receivables.

Proactive risk management Stay ahead with alerts on late-paying customers and ensure healthy cash flow.

Financial management Keep track of payments and cash flow to maintain a strong credit rating.

Indirect credit improvements Pulse enables fiscal insights, encouraging you to monitor finances to increase your credit score.

Optimise Operational Performance

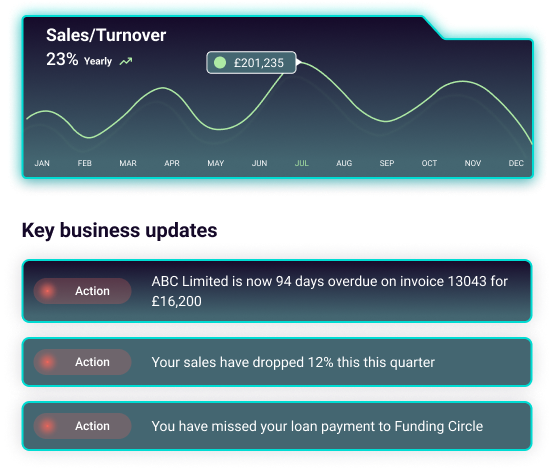

Real-Time financial insights

Our platform offers real-time tracking and trend analysis, helping SMEs make smarter financial decisions. With tools like predictive analytics and KPI tracking, you can optimise cash flow, boost profitability, and stay ahead of market trends. Gain the insights you need to drive growth and improve efficiency.

Remote Access Access real-time financial data anytime to address business challenges.

Seamless Integration Connect effortlessly with open accounting and banking systems for unified financial insights.

Enhanced Decision-Making Make swift, data-driven decisions with clear, actionable visualisations.

MAKE SMARTER BUSINESS DECISIONS WITH CONFIDENCE.

Data-driven decision making

Our platform will provide your business with comprehensive, easy-to-understand, data-driven insights, helping you optimise your business strategies with real-time financial information that our fintech delivers.

Actionable insights Get simplified, clear insights to guide decision-making and drive growth.

Strategic planning Use real-time insights to build strategies that boost business efficiency.

Business optimisation Identify growth opportunities and streamline operations for maximum profitability.

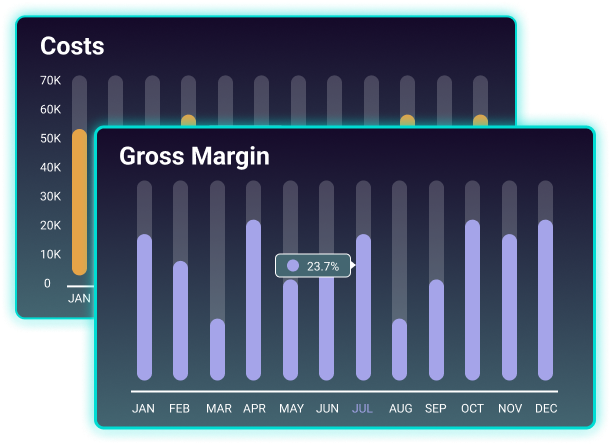

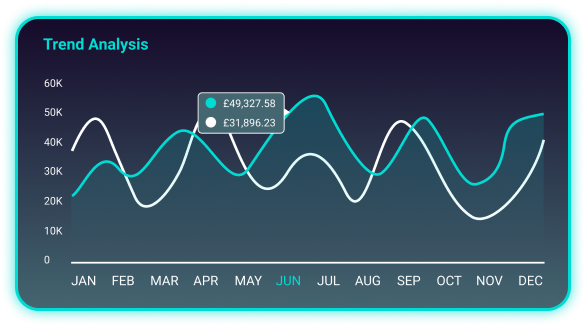

UNDERSTAND YOUR BUSINESS PERFORMANCE

Business performance and trend analysis

We’ll help you take the guesswork out of managing your business by providing precise and detailed insights into your performance through our platform’s robust business performance and trend analysis features. Pulse enables you to monitor your growth's key metrics, including profit margins, sales trends, and even your expense patterns.

Granular Performance Metrics Track key financial indicators like revenue and expenses with precision using advanced visuals.

Trend Analytics & Forecasting Identify and analyse financial trends for proactive, data-driven strategy shifts.

Real-Time Data-Driven Optimisation Optimise operations dynamically with real-time insights to sustain peak performance.

Measure your success with ease

Set and track business KPIs

Setting clear goals is essential for any business, and with Pulse, you can not only set those goals based on the insights our tools provide but also track and monitor them as your business progresses.

Our platform lets you define your key performance indicators based on your unique needs, helping you achieve your business objectives.

Customisable KPIs Tailor and track performance metrics in real-time to align with goals.

Real-Time Monitoring Track key metrics continuously for adaptive strategy execution.

Automated Alerts Get instant notifications for quick, data-driven adjustments.

Cash Flow Forecasting Simplified

aiPredict

aiPredict simplifies forecasting so you can deliver better insights faster. Help clients plan, grow, and make informed decisions with accurate, intuitive financial forecasts.

Client cash flow analysis Quickly review key metrics to spot trends and guide client decisions.

Cash flow forecasting made easy Deliver reliable projections that support tax planning and funding strategies.

Profit and loss forecasts Forecast revenue and costs to support smarter budgeting and advisory.

Balance sheet forecasting Track and project financial positions to support long-term business planning.

GET ACTIONABLE FINANCIAL REPORTS EVERY MONTH

Monthly management accounts

Our reports will give you a comprehensive snapshot of your business’s financial health every month, ensuring you clearly understand how your enterprise is performing. We will pull data from your accounting and banking information and transform it into easy-to-understand reports, highlighting your key metrics to keep you on track.

Automated reporting Get timely, accurate financial reports without manual input.

Clear financial overviews Receive detailed breakdowns of your finances, including income, expenses, and profitability.

Receivables and payables Easily track outstanding invoices and payments for smooth cash flow management.

KEEP TRACK OF YOUR BUSINESS’S CREDIT HEALTH

Business credit score

Pulse provides the tools and insights to help you improve and maintain your creditworthiness, improving your chances of a successful loan application with lenders and ensuring you can get the best loan terms.

Proactive risk management Stay ahead with alerts on late-paying customers and ensure healthy cash flow.

Financial management Keep track of payments and cash flow to maintain a strong credit rating.

Indirect credit improvements Pulse enables fiscal insights, encouraging you to monitor finances to increase your credit score.

Trend Identification: Spot patterns with real-time data analytics to support long-term business growth.

PROTECT YOUR BUSINESS FROM FINANCIAL RISKS.

Fraud detection and prevention

Our platform uses cutting-edge algorithms to spot suspicious patterns in your finances. We constantly monitor for unusual activities and keep your sensitive data safe. We will alert you when something looks off, whether you experience an unauthorised transaction or an irregular financial event.

Real-Time Alerts Receive instant notifications for unauthorised or unusual activity.

Enhanced Fraud Protection Continuous monitoring ensures your finances are protected from fraud.

Industry Benchmarking

Pulse GPT

PROCESS

How it works

From signing up to linking your financial data, getting started with Pulse is quick and easy. Just follow the three simple steps below to begin!

Create your Pulse account by completing our quick and easy registration process

Subscribe to our annual SME package to get full access to the platform

Gain access to real-time financial insights and start tracking your cash flow

Protection

Safe and secure, as it should be

Built on trusted protocols and certified by Cyber Essentials Plus, we make it our priority to deliver class-leading security.

Leveraging the power of Microsoft Azure, Pulse ensures your data is managed on a secure, reliable, and scalable platform. We protect your financial information with comprehensive encryption, both at rest and in transit, and employ stringent security measures such as multi-factor authentication, geo-fencing, and IP restrictions to block unauthorised access.

Explore Now

Remember

Every device and user in the Pulse network benefits from enhanced protection through Microsoft Entra ID, guaranteeing the security of your digital identity at all turns.

PARTNER ECOSYSTEM

Who we work with

At the heart of Pulse, we work with some of the market-leading technology and service providers to deliver the best product capabilities and solutions for SMEs. Whether you're looking to streamline operations, enhance your marketing strategies, or explore new financial technologies, our marketplace is your gateway to a world of expertise.

Explore NowBe a part of our Partner Ecosystem

Join ustestimonials

Why work with us?

Empowering your journey

Crafting Financial Models That Make Venture Capitalists Take Notice

The success of a startup often depends on its ability to secure funding, with the...

READ MORE

Choosing the Right Business Forecasting Tools in 2024

How often do you sit down at your desk, take a look at your emails,...

READ MORE