Empower your clients with data driven advice

Improve client relationships, identify opportunities for them, and create tailored financial strategies through our intuitive real-time platform.

Our Partners

Accreditations

.svg)

Features

What Pulse offers

Master Your Receivables

DebtorIQ

Stay on top of late payments with real-time insights into risky customers, and smart follow-up actions. Built into Pulse, it sends custom alerts and offers a downloadable audit report for a clear, shareable view of your receivables.

Proactive risk management Stay ahead with alerts on late-paying customers and ensure healthy cash flow.

Financial management Keep track of payments and cash flow to maintain a strong credit rating.

Indirect credit improvements Pulse enables fiscal insights, encouraging you to monitor finances to increase your credit score.

ENHANCE CLIENT CREDITWORTHINESS WITH DATA DRIVEN INSIGHTS

Business credit score

Pulse helps enhance clients' credit ratings and negotiate more favourable loan terms by monitoring financial metrics, profitability, and cash flow. It enables you to engage in proactive credit profile management and risk evaluation by detecting changes in client financial health. This information facilitates the ongoing enhancement of clients' creditworthiness.

Proactive credit risk management Assess credit risk early using financial data to provide actionable advice that improves creditworthiness.

Improved Loan Terms Help clients secure better financing by guiding them toward better financial health and an improved credit profile.

Monitored financial health Track cash flow, expenses, and profitability to identify risks affecting clients’ credit standing.

OFFER CUSTOMISED FINANCIAL SOLUTIONS

Personalised client solutions

Pulse offers comprehensive financial information, facilitating tailored solutions that correspond with your client's objectives, like obtaining loans or modifying repayment plans. Enhance client connections by providing actionable insights derived from real-time business data.

Tailored financial advice Provide personalised recommendations that align with your client’s financial situation and goals.

Customisable loan structuring Optimise loan terms and repayment schedules to reduce risk and improve financial health.

Proactive Engagement Anticipate client needs and offer timely, tailored solutions to their business challenges.

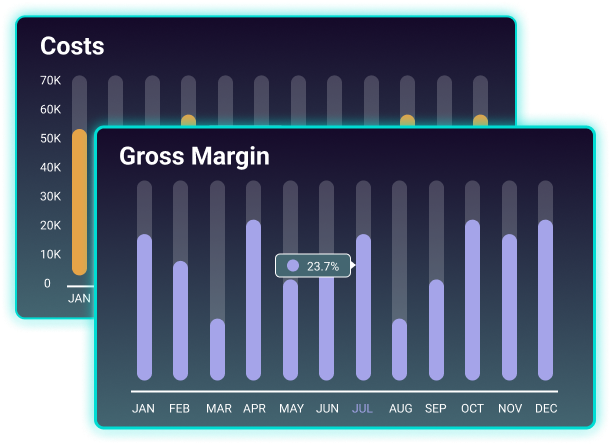

SET MEASURABLE GOALS AND TRACK THEIR PROGRESS

Enhanced client advisory services

Pulse helps you guide your clients by establishing quantifiable targets and monitoring key performance indicators (KPIs) such as revenue, cash flow, and expenses. Real-time monitoring of these KPIs offers critical insights, enabling strategic adjustments based on metrics such as profit margins and growth rates.

Custom KPI setting Set aligned financial goals with your clients to drive long-term growth.

Real-time progress tracking Monitor client progress in real-time to ensure they stay on track and achieve set goals.

Data-driven feedback Gain actionable insights from performance data to improve client strategies and achieve quantifiable success.

Your New Go-To for Smart SME Forecasting

aiPredict

aiPredict simplifies forecasting so you can deliver better insights faster. Help clients plan, grow, and make informed decisions with accurate, intuitive financial forecasts.

Client cash flow analysis Quickly review key metrics to spot trends and guide client decisions.

Cash flow forecasting made easy Deliver reliable projections that support tax planning and funding strategies.

Profit and loss forecasts Forecast revenue and costs to support smarter budgeting and advisory.

Balance sheet forecasting Track and project financial positions to support long-term business planning.

EMPOWER YOUR CLIENTS WITH DATA-BACKED FINANCIAL GUIDANCE

Monthly Management Accounts

Pulse automates the preparation of monthly management accounts, including concise summaries of essential financial aspects such as revenue, expenditures, cash flow, and profitability. This enables you to concentrate on providing strategic counsel rather than aggregating facts.

Automated Reporting Save time with automatically generated monthly accounts detailing your client’s financial health.

Clear Financial Overviews Access easy-to-understand monthly reports summarising key financial metrics like revenue, costs, and profit.

Reduced Administrative Burdens Focus on business advice instead of manual ledgers with Pulse’s automated financial tracking.

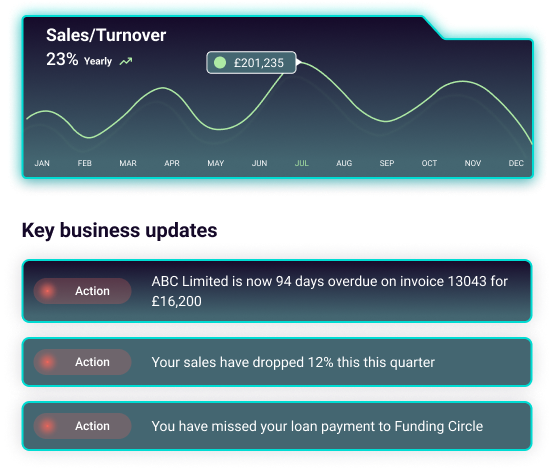

PROVIDE YOUR CLIENTS WITH UP-TO-THE-MINUTE FINANCIAL GUIDANCE

Real-Time financial insights

Access real-time financial insights to monitor your client’s performance, KPIs, and financial health through an intuitive portal. Proactively identify positive and negative trends that enable you to provide accurate guidance. Track cash flow and profitability to deliver data-driven recommendations that help your clients succeed.

Instant access to client data Monitor client performance via web-based portal that delivers real-time data for seamless accounting data analysis.

Proactive Guidance Identify financial issues and trends early to offer proactive solutions.

Customisable platform View and track real-time financial data across clients and industries, monitor performance, and provide strategic recommendations.

SAFEGUARD YOUR CLIENTS FROM FINANCIAL RISKS WITH REAL-TIME ALERTS

Fraud detection and prevention

Pulse will provide cutting-edge risk management tools to set and track business KPIs and monitor your clients' financial data. Receive real-time alerts that will notify you of potential risks and enable you to guide your clients accordingly.

Real-Time Risk Alerts Receive instant real-time notifications about emerging financial risks, such as cash flow issues or missed payments.

Proactive Risk Management Use actionable insights to guide clients through financial challenges, secure their business, and mitigate risk. Leverage actionable insights for effective credit risk monitoring.

Continuous Monitoring Track key financial indicators (KPIs) to address potential risks before they escalate.

STREAMLINE FINANCIAL REPORTING WITH AUTOMATED INSIGHTS

Data-driven decision making

Guide your clients with powerful insights from Pulse. Through consolidated real-time financial data, Pulse helps you guide clients toward informed decisions. Whether it's investment decisions or streamlining operations, Pulse equips you with the tools to offer accurate, data-driven advice.

Informed Resource Allocation Use data-driven recommendations to help clients allocate resources more effectively based on financial performance.

Risk Management Using real-time data, you can identify financial risks early to help your clients take remedial action and minimise or avoid potential losses.

Strategic Growth Planning Develop long-term growth strategies for clients using insights into market trends and financial benchmarks.

Industry Benchmarking

Pulse GPT

PROCESS

How it works

From signing up to linking your financial data, getting started with Pulse is quick and easy. Just follow the three simple steps below to begin!

Join Pulse using our quick and easy registration process

Invite your clients and get your portfolio set up in a few clicks

Guide your clients to seamlessly connect their bank accounts and accounting software

Access your complete client portfolio and see real-time updates from the moment you log in

View business goals set by your clients and track their progress to provide expert guidance

Protection

Safe and secure, as it should be

Built on trusted protocols and certified by Cyber Essentials Plus, we make it our priority to deliver class-leading security.

Leveraging the power of Microsoft Azure, Pulse ensures your data is managed on a secure, reliable, and scalable platform. We protect your financial information with comprehensive encryption, both at rest and in transit, and employ stringent security measures such as multi-factor authentication, geo-fencing, and IP restrictions to block unauthorised access.

Explore Now

Remember

Every device and user in the Pulse network benefits from enhanced protection through Microsoft Entra ID, guaranteeing the security of your digital identity at all turns.

PARTNER ECOSYSTEM

Who we work with

At the heart of Pulse, we work with some of the market-leading technology and service providers to deliver the best product capabilities and solutions for SMEs. Whether you're looking to streamline operations, enhance your marketing strategies, or explore new financial technologies, our marketplace is your gateway to a world of expertise.

Explore NowBe a part of our Partner Ecosystem

Join ustestimonials

Why work with us?

RESOURCES

Empowering your journey

Crafting Financial Models That Make Venture Capitalists Take Notice

The success of a startup often depends on its ability to secure funding, with the...

READ MORE

Choosing the Right Business Forecasting Tools in 2024

How often do you sit down at your desk, take a look at your emails,...

READ MOREFAQs

Unlock financial insights today

Get access to real-time business insights and analytics